Product Details

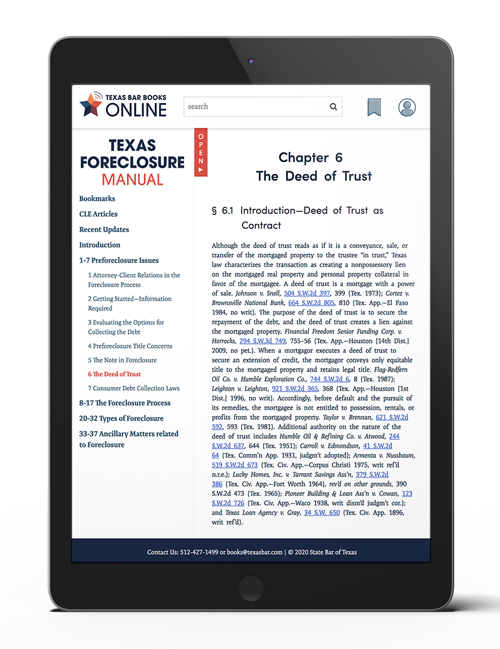

Texas Foreclosure Manual Online includes:

- Online access

- Editable Word forms

- Future updates

- Website-based search function

ISBN: 978-1-938873-75-1 © 2014, 2015, 2018, 2019

Summary of Contents

VOLUME 1

1 Attorney-Client Relations

2 Getting Started—Information Required

3 Evaluating the Options for Collecting the Debt

4 Preforeclosure Title Concerns

5 The Note in Foreclosure

6 The Deed of Trust

7 Consumer Debt Collection Laws

8 Demand for Payment, Notice of Intent to Accelerate, and Notice of Acceleration

9 Collection of Rent by Lender before Foreclosure

10 Borrower Challenges to Foreclosure and Lender Responses

11 Trustees and Substitute Trustees

12 Notice of Foreclosure Sale

13 Bid Evaluation

VOLUME 2

14 Conducting the Sale

15 Postsale Considerations

16 Consequences of Wrongful Foreclosure

17 Suits for Deficiency

20 Judicial Foreclosure

21 Residential Foreclosure Process

22 Commercial Foreclosure Process

23 Tax Consequences of the Foreclosure Process

24 Foreclosures Resulting from Ad Valorem Taxation

25 Property Tax Loan Foreclosure Process

26 Deceased Mortgagor Foreclosure Process

27 Condominium Foreclosures

28 HEL/HELOC Foreclosure Process

29 Manufactured Housing Unit Foreclosure Process

30 Property Owners Association Foreclosure Process

31 Reverse Mortgage Foreclosure Process

32 USDA Farm, Ranch, and Housing Loan Foreclosures

33 Servicemembers Civil Relief Act

34 Residential Evictions Following Foreclosure

35 Environmental Issues Affecting the Foreclosure Process

36 Federal and State Foreclosure Assistance Programs

37 Miscellaneous Topics

Appendix A—IRS Collection Advisory Group Addresses and Counties by Areas

Appendix B—Texas County Foreclosure Resources

Statutes and Rules Cited

Cases Cited

List of Forms by Title

Subject Index

LPM Help Center

LPM Help Center